I've made few Tallman Education Report posts since the end of the Legislative session in early June. My excuse is the 24 meetings we held in communities

across the state between June 3 and June 28 to discuss education issues with school leaders - a wonderful to spend early summer in Kansas! Except for a long Independence Day weekend, my KASB advocacy staff colleagues and I then spent most of the last two-and-a-half weeks compiling and analyzing information survey data we collected for the KASB Legislative Committee, which met last Saturday, and writing up the results of that meeting. For next several days, I'll share we learned.

The target audience was school board members and administrative

leadership. A number of teacher leaders and

retired teachers also attended; as well as six state Legislators and two State

Board of Education members, plus a small number of other community patrons at

some meetings. Final attendance was

approximately 400: 45% board members; 38% administrators; and 17% all others,

mostly teachers.

The meetings focused on three

issues: (1) suitable education finance; (2) state standards and assessments;

and (3) collective bargaining between boards and teachers. Each of these topics included background presentations by KASB staff; a survey instrument to be filled out by the participants

individually; and both small and large group discussions of the topic. We compiled survey results for three major groups: board members, administrators and

all others. Today, I'll report what we heard about school finance.

First, we presented a review of what the Legislature appropriated for K-12 funding for the next two school years (2013-14 and 2014-15), and assumptions used to make projections about state revenues and expenditures for the following three years, through 2018. In short, these projections indicate that school operating budgets will increase slightly over the next five years, but most likely less than the rate of inflation and enrollment growth.

Is more revenue needed?

Participants were then asked to fill out a form to indicate which

of the following statements most closely matched their views: (A) Meeting the constitutional

requirement to provide suitable finance for education improvement will require

more financial resources; (B) Suitable education finance

should be accomplished by reallocating existing resources; (C) Suitable education funding

should be accomplished by both increasing and reallocating resources; or (D) Kansas is spending more than

is needed to improve education, and funding can be reduced.

Slightly more than half of board members and teachers/others said that suitable funding would require both more resources AND reallocating existing resources, while just under 45% of both groups said more resources were required without reallocation. Administrators favored more resources alone by 58% to 42%. A very small percentage of board members and teachers/others said suitable funding could be provided by reallocating existing resources; but no board members or administrators thought resources could be reduced.

How should more revenue be raised?

Next, if participants picked option A, supporting more resources only; or C, supporting both more

resources and reallocation, they were asked to choose which tax revenues should be increased to provide the additional resources. The choices were income, sales or property

taxes. They could also mark "other;" with a space to list alternative suggestions. More than one source could be chosen.

Governor Sam Brownback and Legislative leaders strongly support reducing and ultimately eliminating the

state income tax. The 2012 Legislative

passed a bill reducing state income tax revenue by approximately 25% this year,

and the 2013 Legislature passed a bill to further income tax rates through 2018

and beyond. As a result, projections

indicate that state revenues, and therefore school funding, is likely to be

essentially flat over the next five years, unless economic growth increases dramatically (or dynamically).

State revenues would be even lower if the Legislature had not narrowly

approved an extension of a higher state sales tax rate; a measure opposed by

Democrats and most moderate Republicans.

However, participants who

believe more revenue is needed to improve education overwhelmingly support

raising income taxes, and the second highest level of support is for the sales

tax. It is unclear why there is such a sharp difference between state elected officials and local education officials, since the same voters pick them both.

Interestingly, there was some difference between

those choosing revenue only and those choosing both revenue and reallocation. For those supporting more revenue without reallocation; about 90% of board members

and teachers/others picked income tax, and less than 50% of both groups

selected sales tax; while about 80% of administrators supporting revenue only

picked income tax and 60% favored sales tax.

For those supporting both more

revenue AND reallocation, somewhat lower percentages of board members and

teacher/others supported income tax (around 74%); and higher percentages of

board members supported sales tax (over half of each group). Among administrators supporting both revenue

and reallocation, about 80% supported both income and sales tax.

I suggest these two groups might be called the "purists" and the "realists." The first group believes schools simply need more funding and cannot be cut without hurting quality. They are more likely to favor a "progressive" income tax, and don't mind opposing the Governor and majority party. The second group may not actually FAVOR cutting some areas of school spending to go along with more revenue, but in discussions many said they were just facing political reality. That group was more willing to support sales tax along with income tax if it is the only way to raise revenue.

Less than 25% of any group

supported increasing property taxes to raise more revenue, which could be

either an increase in the statewide mill levy or more local funding raised through

property tax levies.

In summary, most most school leaders believe the best way to get more revenue for schools is through the income tax, which the Governor and a majority of legislators want to reduce or eliminate because they believe it will boost the state economy. The second-best choice is the sales tax, which most Democrats and moderates wanted to see reduced because they believe it is unfair to lower income Kansans. The worst choice is the property tax. That may be because school leaders think the PUBLIC hates the property tax most; or because it a tax school boards may have to vote to raise (if the Legislature provides authority to increase their Local Option Budget), or because there is so much disparity in property tax rates - or all of the above.

At least one-third of each group supported "other" revenue

sources. A common suggestion was

repealing various tax exemptions, loopholes or credits, which would increase

income, sales or property taxes for certain specific taxpayers or groups,

rather than a general rate increase. Other common suggestions were to use state lottery or gaming revenues, or to raise "sin taxes" such as levies on alcohol and tobacco.

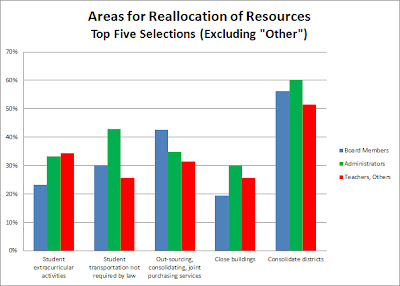

Where can spending be reduced or reallocated?

Finally, participants who selected either reallocation of resources,

a combination of raising revenue and relocation, or reducing resources were asked to choose among nine school district budget areas for places

funding could or should be reduced. They were also allowed to pick "other" and offer suggestions.

The top five areas were the same for each group, although the

order varied somewhat. The

top choice by far for all groups, picked by at least 50%, was consolidation of

districts. That's surprising

because district consolidation has long been considered virtually untouchable both

in the Legislature and within KASB. It should be stressed, however, that no respondents offered to volunteer THEIR own districts to be consolidated!

The second highest area for boards and teachers/others and the third highest for administrators was outsourcing or consolidating

“non-instructional” services and support functions, including joint

purchasing. This was a major area of

interest by the Governor’s School Efficiency Task Force and KASB’s special

committee last fall on the same issue; and has been advocated by the Kansas

Policy Institute. Despite evidence that

a considerable amount of “sharing” and outsourcing is already occurring, it

appears many KASB members believe more can be done.

Others areas ranking high for possible reductions were

student activities and transportation for students not required by state law,

which could entail student fees. The

final “top five” area was closing buildings.

As far as the least popular areas for budget reductions, between 15% and 20% of each group picked teacher positions

for possible cuts, which could include increasing class size, changing

scheduling, and reducing courses with low enrollment – choices that could

affect students looking for both higher level college prep classes and more

specialized vocational courses. Interestingly,

this choice would reduce funding for “instruction” or “in the classroom”

spending, but received much more support than cutting leadership (principals,

superintendents, etc.) and instructional and student support areas – even from

teacher/others.

Although about one-third of respondents marked the category of

“other," most of these suggestions were actually duplicates of other categories, plus a handful of suggestions for more revenue at the local level. Multiple respondents proposed reducing state mandates to reduce costs.

Next, I'll look at how school leaders viewed the issue of state academic standards and assessments.

.bmp)

.bmp)

No comments:

Post a Comment

(Comments on this blog are moderated.)