Key points:

- Over 80 percent of increased funding went to instruction and other programs and services directly impacting students and teachers.

- Over 80 percent of the increased funding went to school district employee salaries, benefits and retirement contributions or to contracted services.

- School districts used most of increased funding provided for general operating purposes on programs for students with special needs, as identified by the Kansas Supreme Court.

In depth:

Total school district expenditures increased $407 million in the 2017-18 school year over the previous year. Approximately $200 million of that increase was provided by the Legislature for base state aid, students weightings and local option budget authority in response to the Gannon school finance decision.

Another $130 million was appropriated by the Legislature for Kansas Public Employees Retirement System contributions, which had been reduced previous year. These funds “pass through” district budgets and are based on employee salaries, but school districts have no control over how these funds are spent.

The remainder of the increase came from increased capital outlay revenues from local mill levies due to higher valuation; increased payments for school construction bonds approved by local voters, and other local revenues such fees for meals and materials.

Here are highlights:

By “function” – Over 80 percent of increased funding went to instruction and other programs and services directly impacting students and teachers.

The largest increase in funding - $229 million – went to instruction, which pays for salaries of teachers, paraprofessional, classroom aides and classroom supplies.

Other functions providing direct services to students and teachers – student support, instructional support, school administration, transportation and food services – accounted for $98.2 million.

Functions that provide for construction and operation of school facilities – operations and maintenance, facilities construction and debt service – increased $63.1 million.

The smallest increases – a total of $16 million – went to central services and district administration, which supports superintendents, district office, legal and business operations.

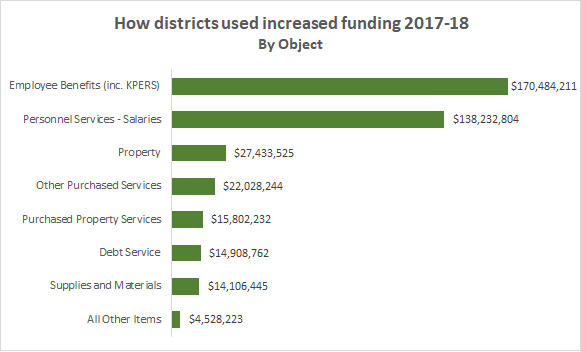

By “Object” – Over 80 percent of the increased funding went to school district employee salaries, benefits and retirement contributions or to contracted services.

As noted, the Legislature provided a significant increase in KPERS contributions. The increase was partially due to the reduced funding the year before (Fiscal Year 2017) to balance the state’s budget, and partly due to a scheduled increase in contribution rates to address the unfunded liability in the KPERS system. These funds simply pass through a school district’s budget and cannot be used for any other purpose. These funds are also not part of the district’s general fund budget or local option budget.

The largest portion of the 2018 school funding increase went to employee benefits: $170 million. Approximately $130 million of that increase was due to the increased KPERS contribution. The balance would be other employee benefits, such as increased health insurance contributions.

The second largest share of the increase, $138 million, was for school district employee salaries (which do not include KPERS and other benefits.

In total, salaries, benefits and retirement contributions for school employees accounted for approximately three-quarters of the 2018 school funding increase.

Another $37.8 million was use for “purchases services or property services” – basically, to pay contractors for services provided by employees of other entities, such as education services centers, construction contacts, transportation and food service (for districts that “outsource” those activities).

Districts spent $41.5 million of the increase to purchase property, equipment, supplies and materials.

Increased payments on school debt and other costs accounted for less than $20 million of the increased funding.

By “Fund” – School districts used most of increased funding provided for general operating purposes on programs for students with special needs, as identified by the Kansas Supreme Court.

School districts are required to use fund-based accounting to track spending in specific programs. For example, state aid for at-risk students and special education and required to be deposited in those funds and spent on programs in those areas.

The largest increase in spending by fund was for KPERS retirement contributions, over $130 million. As noted, these funds are deposited in this fund and immediately transferred to the KPERS system, and cannot used for general operating purposes.

As far as funds provided for the Legislature in response to Gannon school finance decision on adequacy, an increase of $78.7 million was spent from the At-Risk and At-Risk preschool funds for services to students who are not performing at standards. Another $48.7 million was spent from the special education and special education cooperative funds for students with disabilities. An additional $8.7 million was provided for increased vocational education and bilingual education programs.

These programs targeted special needs students had a total increase $136.1 million. Increased expenditures from the school district general fund and local option budgets for general education and operating purposes totaled $81.7 million.

Most of the remainder of the increase in spending was in restricted funds that cannot be used for general operations. Expenditures from the capital outlay fund, which is supported by local capital outlay mill levies and state aid, increased by $40 million. These funds can only be used for construction, remodeling, equipment and limited building maintenance purposes defined by the Legislature.

Payments from school district bond and interest funds rose by $7.3 million. These funds come from local mill levies for construction bonds approved by local voters, and state aid for this purpose.

No comments:

Post a Comment

(Comments on this blog are moderated.)